does california have an estate tax in 2021

For tax year 2017 the estate tax exemption was 549 million for an individual or twice that for a couple. Again as noted it is still important to put in place an estate plan so that your estate avoids probate.

1816 Paseo Del Mar Palos Verdes Estates Ca 90274 Zillow

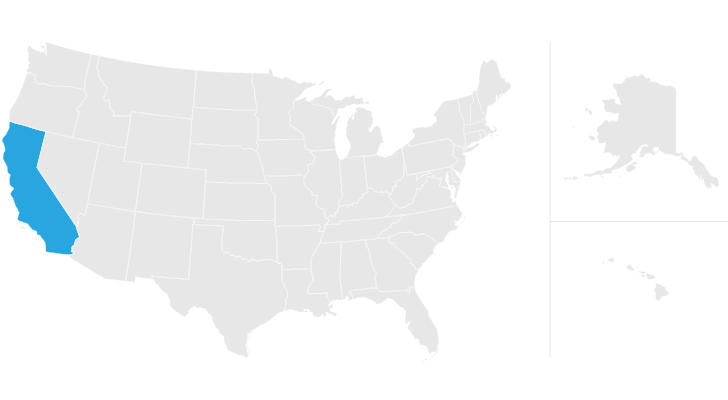

However California is not among them.

. The Estate Tax Exemption. The cumulative lifetime exemption increased to 11700000 in 2021 until after 2025 indexed for. With marginal rates you only pay a certain tax rate on the money that falls within the bracket.

Currently the federal and gift tax lifetime exemptions for individuals is 112 million and 224 million for wealthy couples. Each California resident may gift a certain amount of property in a given tax year tax-free. Alternative Minimum Tax California Perfect Tax.

Although both impose a tax on assets left behind by a decedent the similarities end there. It took a big jump because of the new tax plan that President Trump signed in December 2017. The tax would also phase out at the current Federal exemption rate.

In 2021 this amount was 15000 and in 2022 this amount is 16000. The federal estate tax has marginal tax brackets that range from 18 to 40 for the 2021 and 2022 tax years. The estate tax exemption is adjusted for inflation every year.

The federal estate tax exemption for 2022 is 1206 million. Moreover with a full credit for federal transfer taxes only estates between 3500000 and 11400000 will be subject to the California tax. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation.

The size of the estate tax exemption meant that a mere 01 of. However the new tax plan increased that exemption to 1118 million for tax year. Since 2013 the IRS estate tax exemption indexes for inflation.

The proposed California gift and transfer tax rate will be equal to the marginal federal transfer tax rate imposed on lifetime gifts and transfers at deathessentially a 40. For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return. Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax.

After you die the only tax imposed on your estate in California is the federal estate tax. Effective January 1 2005 the state death tax credit has been eliminated. Product reviews advice how-tos and the latest news - CNET.

As of 2021 12 states plus the District of Columbia impose an estate tax. Does California Impose an Inheritance Tax. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax.

Wealthy Californians Are Subject to the Federal Estate Tax The federal estate tax despite perennial calls by some political groups for its repeal is still in place although who is affected by it changes by the year. The federal government does not levy an inheritance tax. California does not have an inheritance tax or a death tax in 2021.

If the property you leave behind to your heirs exceeds your lifetime gift and estate tax exemption of 114 million in 2019 or 1158 million in 2020 youd owe a federal estate tax on the portion that exceeds. More about the California bill The CA senate has introduced a bill which would impose a CA gift estate and GST tax in 2021. The tax-free annual exclusion amount increased to 15000 in 2018 and remains the same in 2021.

The bill calls for a 35M exclusion but allows for a full credit for Federal estate and gift tax paid. Home does california have an estate tax in 2021. If you held property in other states some of them might also collect inheritance tax and state-level estate taxes on your estate.

As of 2021 states that impose an inheritance tax are Iowa Maryland Kentucky Nebraska Pennsylvania and New. You can see the federal estate tax rates in. Gift and Estate Tax.

707 Park Ln Santa Barbara Ca Santa Barbara Storybook Homes Ranch Style Home

10 Most Expensive Neighborhoods In San Diego County Orvis Realty Group Keller Williams Realty La Jolla Real Estate California Real Estate Beachfront

California Inheritance Laws What You Should Know Smartasset

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

California Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Prop 19 And How It Impacts Inherited Property For California Residents Financial Alternatives

For Home Flippers In California A Proposed Tax Could Make A Quick Sale Costly Mansion Global

Is Inheritance Taxable In California California Trust Estate Probate Litigation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

25919 Dark Creek Rd Calabasas Ca 91302 Zillow

Is Inheritance Taxable In California California Trust Estate Probate Litigation